- #THREE STEPS OF ACCOUNTING PROCESS FULL#

- #THREE STEPS OF ACCOUNTING PROCESS SOFTWARE#

- #THREE STEPS OF ACCOUNTING PROCESS SERIES#

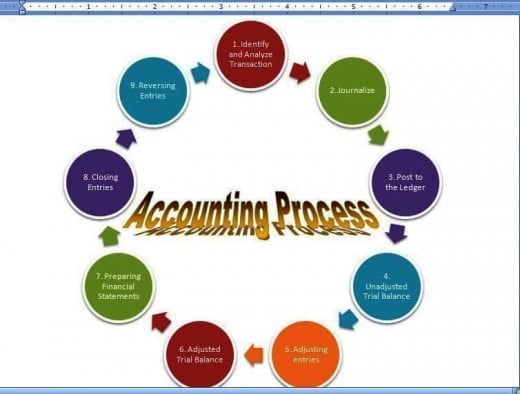

Proof of this transaction, mentally analyze the transaction's effects on the accounting equation. Important because they are the ultimate proof of business transactions.Īfter you have determined that an event is a measurable business transaction and have adequate Has occurred is a source document such as a sales ticket, check, and so on. One fundamental criterion: They must have caused a measurable change in the amounts in theĪccounting equation, Assets = Liabilities + Stockholders' Equity. Party, such as the sale of a book, or they can involve paying salaries to employees. Measurable in terms that affect the solvency and profitability of the business.īusiness transactions can be the exchange of goods for cash between the business and an external These two events may briefly interrupt the operation of the business. For example,Īssume that the owner of a business spilled a pot of coffee in her office or broke her leg while skiing. Transactions are measurable events that affect the financial condition of a business. Before you can visualize theĮight steps in the accounting cycle, you must be able to recognize a business transaction. Throughout the period and some at the end) to analyze, record, classify, summarize, and report usefulįinancial information for the purpose of preparing financial statements.

#THREE STEPS OF ACCOUNTING PROCESS SERIES#

In addition, continuous monitoring will be easier to accomplish using data sets that are comprehensive.Īccounting professionals who can adapt to quickly changing technology such as data analytics will not only expand the scope of their expertise but also provide financial guidance that will give their companies and clients a strong strategic advantage over competitors.The accounting cycle is a series of steps performed during the accounting period (some

#THREE STEPS OF ACCOUNTING PROCESS FULL#

Accountants can use data analytics to make more accurate and detailed forecasts help companies link diverse financial and nonfinancial data sets, which provides a more comprehensive reporting of their overall performance to shareholders and others assess and manage risk across the entire organization and identify possible fraud.ĭata analytics can also improve and enhance the auditing process because more information will now be collected, which allows for analysis of full data sets in situations where only samples were audited previously. Using data analytics effectively can help businesses increase revenue, expand operations, maximize customer service, and more. With the revolution of computer technology, automation, and data collection from a myriad of sources, accountants can use data analytics to provide a clearer picture of the overall business environment for their companies and clients on an ongoing basis.ĭata analytics can be defined as the process of examining numerous data sets (sometimes called big data) to draw conclusions about the information they contain, with the assistance of specialized systems and software. Not long ago, an accountant’s work finished when business financial statements were finalized and tax forms were ready to be filed with federal, state, and local governing bodies. Historically described as “paper pushers” who track financial information, today’s accountants need to learn about big data and data analytics as part of their continuing education.

As the accounting field continues to take advantage of technological advances, it is important that data analytics become a key element of any accounting professional’s toolbox. Knowledge is power, and understanding what your customers want and how your company can provide it often differentiates you from the competition. Although these technological advances in accounting applications have made the financial aspects of running a small business much easier, entrepreneurs and other small-business owners should take to time to understand underlying accounting principles, which play an important role in evaluating just how financially sound a business enterprise really is.

#THREE STEPS OF ACCOUNTING PROCESS SOFTWARE#

Accounting software ranges from off-the-shelf programs for small businesses to full-scale customized enterprise resource planning systems for major corporations. The Big Four and many other large public accounting firms develop accounting software for themselves and for clients.Īccounting and financial applications typically represent one of the largest portions of a company’s software budget. Point-of-sale terminals used by many retail firms automatically record sales and do some of the bookkeeping. Tax programs use accounting data to prepare tax returns and tax plans. For example, most accounting packages offer basic modules that handle general ledger, sales order, accounts receivable, purchase order, accounts payable, and inventory control functions. Computerized and online accounting programs now do many different things to make business operations and financial reporting more efficient. Over the past decade, technology has had a significant impact on the accounting industry.

0 kommentar(er)

0 kommentar(er)